Life Insurance in and around Grand Rapids

Life goes on. State Farm can help cover it

Now is a good time to think about Life insurance

Would you like to create a personalized life quote?

- Cleveland, OH

- Creston, MI

- Highland Parks

- Grand Rapids, MI

- Green Bay, WI

- Indianapolis, IN

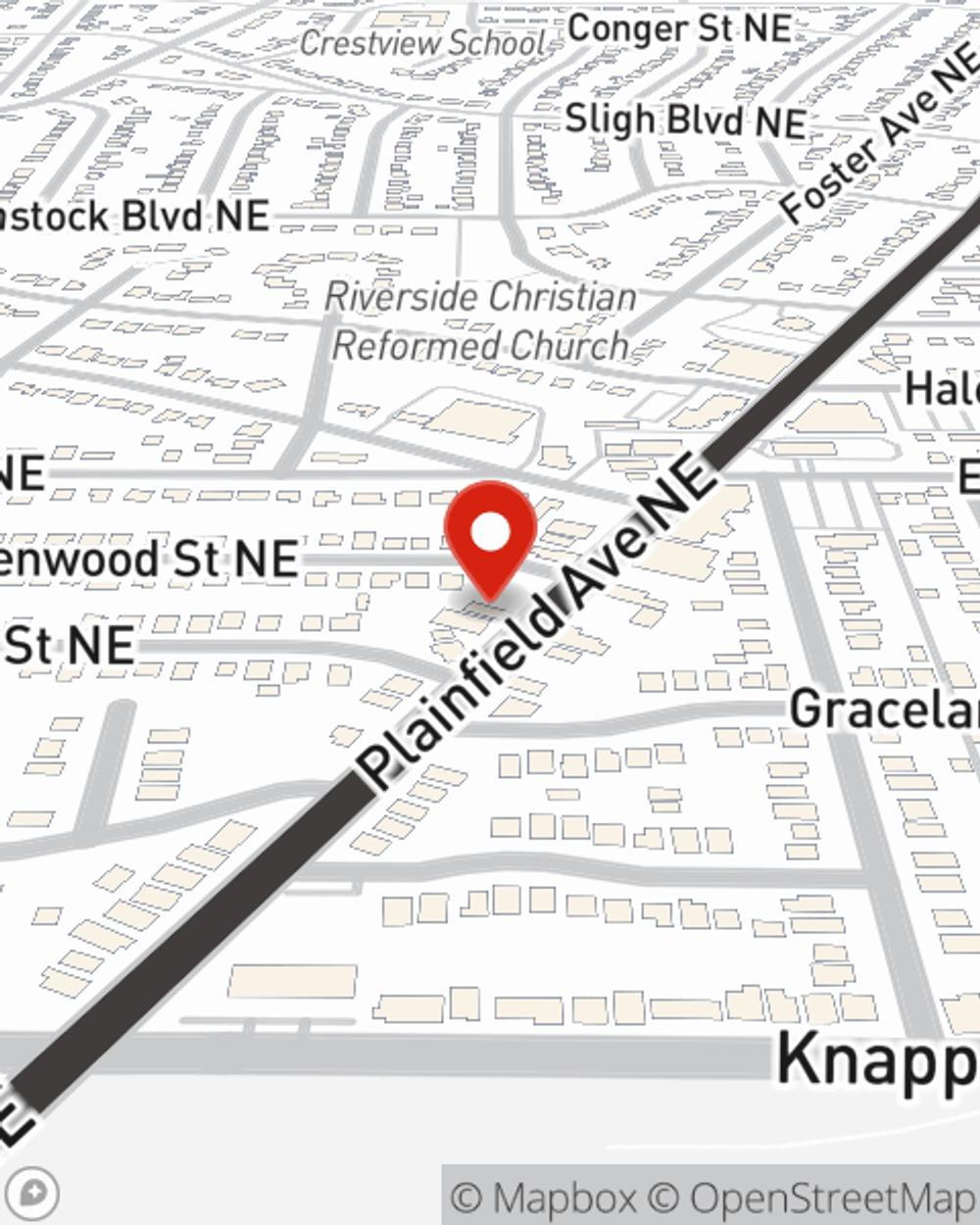

- Plainfield Ave

- East Grand Rapids

- Ada, MI

- Alpine, MI

- Comstock Park, MI

- Northview, MI

- Milwaukee, WI

- Madison, WI

- South Bend, OH

- Toledo, OH

- Fort Wayne, IN

- Columbus, OH

- Rockford, MI

- Allendale, MI

- Kentwood, MI

- Wyoming, MI

- Walker, MI

- Grandville, MI

Check Out Life Insurance Options With State Farm

Buying life insurance coverage can be a lot to consider with a variety of options out there, but with State Farm, you can be sure to receive compassionate considerate service. State Farm understands that your primary reason is to protect your loved ones.

Life goes on. State Farm can help cover it

Now is a good time to think about Life insurance

Put Those Worries To Rest

When opting for how much coverage you need, it's helpful to know the factors that play into the type and amount of Life insurance you need. These tend to be things like the age you are now, your physical health, and perhaps even body weight and lifestyle. With State Farm agent Greg Winczewski, you can be sure to get personalized service depending on your particular situation and needs.

It's always a good time to make sure your loved ones have coverage against the unexpected. Call or email Greg Winczewski's office to explore what State Farm can do for you.

Have More Questions About Life Insurance?

Call Greg at (616) 451-2857 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

Benefits of owning a life insurance policy to cover your final expenses

Benefits of owning a life insurance policy to cover your final expenses

Final expense insurance (or burial insurance) can help relieve the burden of funeral planning. We'll explore details of guaranteed issue life insurance.

What are the different types of insurance?

What are the different types of insurance?

You can have more coverage than just car insurance, homeowners insurance, and life insurance. Learn about options for these and other types of policies.

Greg Winczewski

State Farm® Insurance AgentSimple Insights®

Benefits of owning a life insurance policy to cover your final expenses

Benefits of owning a life insurance policy to cover your final expenses

Final expense insurance (or burial insurance) can help relieve the burden of funeral planning. We'll explore details of guaranteed issue life insurance.

What are the different types of insurance?

What are the different types of insurance?

You can have more coverage than just car insurance, homeowners insurance, and life insurance. Learn about options for these and other types of policies.